- Introduction

Solar energy is rapidly becoming one of the most promising sectors in Canada’s renewable energy landscape. From small-scale residential installations to large commercial projects, the shift toward solar power has led to a tangible rise in demand for skilled solar panel installers. This development presents a unique opportunity for both solar companies and contractors looking to hire personnel who can keep projects on track and meet Canada’s growing appetite for green energy solutions.

1.1 Purpose and Scope of the Article

The primary goal of this piece is to help solar panel companies and contractors better understand the magnitude of Canada’s solar panel installer demand. By highlighting the driving forces behind this surge, we reveal why it’s crucial for industry stakeholders to develop targeted hiring strategies. This article also outlines the essential skills and qualifications that installers should possess, offers a provincial breakdown of demand, and explores how government programs influence workforce needs.

1.2 Why Solar Panel Installation Demand Is Rising in Canada

Canada has long recognized the value of diversifying its energy mix. With ambitious federal and provincial goals to reduce carbon emissions, solar power has taken center stage. Lower installation costs, advancements in photovoltaic (PV) technology, and a supportive regulatory framework have all played a part in making solar a mainstream energy option. The cascading effect is clear: as more households and businesses choose solar, the market for skilled installers continues to climb.

-

Overview of the Canadian Solar Industry

A proper grasp of the Canadian solar industry sets the stage for understanding why installer demand is surging. This section explores the current market size, growth projections, and factors like government incentives and competitive dynamics that underpin robust demand.

2.1 Current Market Size and Growth Projections

- Steady Expansion: In the past decade, Canada’s solar sector has shown a consistent uptick in installed capacity. Residential rooftops, corporate campuses, and community-based solar farms are now commonplace in provinces such as Ontario, Alberta, and British Columbia.

- Market Value: Recent estimates suggest that the Canadian solar industry is poised to surpass several billion dollars in annual revenue over the coming years. This growth is propelled by both large-scale utility projects and distributed generation systems (small to medium installations at sites like homes and businesses).

- Future Capacity Goals: Provincial mandates often set specific targets for renewable energy. As a result, many local governments have earmarked solar as a critical component in their energy transition plans. These targets invariably translate into heightened hiring needs as new projects come online.

Key Insight:

The alignment of government ambitions, declining costs, and an expanding pool of eco-conscious consumers fosters a dynamic market environment. This synergy ensures ongoing project rollouts, thereby driving constant demand for experienced installers.

2.2 Government Incentives and Policy Framework

Canada’s policy landscape is particularly hospitable to solar energy. Multiple federal and provincial programs incentivize the adoption of renewable power sources, often through tax credits, rebates, and loan schemes.

- Federal-Level Support:

- Investment Tax Credits (ITCs): Homeowners and businesses can write off a portion of their solar installation costs, making the transition more financially feasible.

- Green Funding Programs: Various federal agencies support large-scale solar farms, pushing utility providers to develop new sites and requiring more installers.

- Provincial Initiatives:

- Net Metering Policies: Many provinces allow system owners to feed excess electricity back into the grid, offsetting future bills. This arrangement spurs rooftop installations and thus raises installer demand.

- Renewable Portfolio Standards (RPS): Some regions mandate that a certain percentage of electricity come from renewable sources, including solar. These standards elevate project volumes, driving intense competition for skilled labor.

Key Insight:

The presence of robust incentive programs and policy support reduces the financial hurdles of solar projects. In turn, both commercial and residential clients feel confident investing in solar infrastructure, which amplifies the need for installation specialists.

2.3 Key Players and Competitive Landscape

The Canadian solar sector comprises an array of stakeholders:

- Manufacturers and Distributors: Companies producing solar panels and associated hardware.

- Engineering, Procurement, and Construction (EPC) Firms: Specialized firms handling complete project lifecycles.

- Independent Contractors: Smaller outfits focusing on residential or commercial rooftop installations.

- Large Utilities and Investors: Entities managing utility-scale solar farms, frequently outsourcing installation work to contractors.

As these players vie for a share of the expanding solar market, they also find themselves competing for top-tier talent. Skilled solar panel installers with a proven record often receive multiple job offers, underscoring the high-demand, low-supply dynamic that characterizes the industry.

-

Factors Driving Demand for Solar Panel Installers

Several interlinked factors contribute to the robust need for qualified solar panel installers. These range from a general shift in consumer sentiment toward renewable energy to breakthroughs in technology and an ever-widening recognition of the economic advantages of going solar.

3.1 Consumer Awareness and Adoption

- Environmental Consciousness: Many Canadians are keen to reduce their carbon footprint. That growing awareness translates into a rising interest in solar panels, spurring a wave of rooftop and ground-mounted installations.

- Energy Independence: Some homeowners seek independence from utility rate increases. Installing solar panels allows them to manage their energy generation, store surplus power (with batteries), and minimize reliance on the grid.

- Peer Influence: Word-of-mouth testimonials and visible solar arrays in neighborhoods often motivate new clients to explore the same technology.

This heightened awareness feeds a cycle of demand: as more consumers become comfortable with the concept of solar, more installations are booked—and more trained labor is needed to complete the work.

3.2 Technological Advancements in Solar Equipment

Modern innovations in solar panel design, battery storage, and inverters have made installations simpler and more efficient:

- High-Efficiency Panels: Today’s panels can convert more sunlight into usable electricity than older models, boosting project ROI and decreasing payback periods.

- Modular Components: Many systems now come with standardized mounts and wiring solutions, expediting setup and reducing labor time per project.

- Smart Monitoring Systems: Digital platforms allow both installers and homeowners to track performance in real time, identifying issues and optimizing consumption.

These technical breakthroughs can reduce the physical labor required in some installations. However, they also demand a more technically savvy workforce—individuals capable of integrating advanced electronics, troubleshooting smart systems, and ensuring that new technologies function seamlessly.

3.3 Environmental and Economic Benefits

Solar energy offers numerous advantages that resonate deeply with homeowners, businesses, and institutions:

- Reduced Carbon Emissions: Lower reliance on fossil fuels directly cuts greenhouse gas output.

- Long-Term Cost Savings: Though the upfront cost of a solar system can be high, reduced utility bills and incentives quickly offset this investment.

- Community and Corporate Social Responsibility (CSR): Companies deploying solar demonstrate a commitment to sustainability, appealing to environmentally conscious customers and investors.

Because these benefits are widely recognized, interest in solar is no longer confined to a niche. Mainstream acceptance is accelerating, augmenting the total number of projects that must be staffed by qualified solar panel installers.

-

Skillsets and Qualifications for Solar Installers

While enthusiasm for hiring is strong, solar companies need competent personnel ready to tackle the technical and regulatory nuances of each project. Below are the core skillsets and credentials that many Canadian employers look for when staffing their solar installation teams.

4.1 Educational Requirements and Certifications

- Secondary Education: A high school diploma is often the minimum requirement.

- Technical Programs: Post-secondary certificates or diplomas in renewable energy, electrical engineering, or construction trades can greatly improve job prospects.

- Certification Bodies:

- NABCEP (North American Board of Certified Energy Practitioners): Though U.S.-based, its certifications are increasingly recognized in Canada for solar PV installation proficiency.

- CSA Group: The Canadian Standards Association offers training modules that bolster an installer’s knowledge of national electrical codes and safety standards.

Key Insight:

Formal training programs often impart both technical acumen and hands-on experience, allowing new entrants to learn proper mounting, wiring, and safety protocols. This specialized education gives them a competitive edge in a tight labor market.

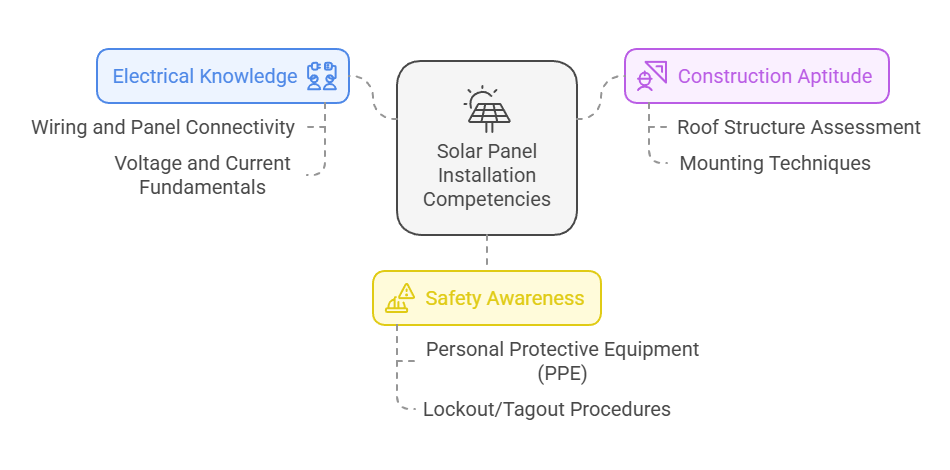

4.2 Technical Expertise (Electrical, Construction, Safety)

An installer’s day-to-day responsibilities range from climbing rooftops to making precise electrical connections. Companies typically seek candidates who demonstrate:

- Electrical Knowledge:

- Wiring and Panel Connectivity: Understanding wiring schematics, inverter setup, and battery integration.

- Voltage and Current Fundamentals: Basic electrical theory ensures safe, compliant installations.

- Construction Aptitude:

- Roof Structure Assessment: Determining load-bearing capacity, potential hazards, and the best angles for optimal sunlight exposure.

- Mounting Techniques: Proper handling of brackets, rails, and other supports to secure panels in place.

- Safety Awareness:

- Personal Protective Equipment (PPE): Knowledge of harnesses, boots, gloves, and helmets to mitigate fall risks.

- Lockout/Tagout Procedures: Ensuring electrical systems are de-energized before performing any wiring tasks.

4.3 Soft Skills and On-the-Job Experience

While technical prowess is essential, effective communication and problem-solving acumen significantly enhance an installer’s performance:

- Customer Interaction: Many installers liaise directly with homeowners or business owners, explaining system features and addressing concerns.

- Collaboration: Installation teams often work in groups, coordinating tasks to streamline project timelines.

- Adaptability: Weather variables, last-minute component changes, and scheduling shifts demand flexible, quick-thinking professionals.

Employers consistently highlight these soft skills as difference-makers in overall job satisfaction and client impressions. Some workers may learn such skills on the job, while others bring them from backgrounds in construction, sales, or customer service.

-

Regional Demand Breakdown

Canada’s solar boom is not confined to one province. Still, each region exhibits distinct market characteristics driven by local policies, climate conditions, and consumer preferences. Understanding these dynamics is vital for solar companies aiming to optimize their recruiting efforts and for job seekers looking to capitalize on regional opportunities.

5.1 Provincial Analysis (Ontario, Alberta, BC, etc.)

- Ontario:

- Key Market Drivers: Historically robust incentive programs, such as the now-closed MicroFIT initiative, spurred early adoption. While direct rebates have waned, net metering remains popular, keeping demand for installers solid.

- Urban vs. Rural: Urban areas see a blend of commercial and residential projects, whereas rural sectors often use off-grid or microgrid solutions.

- Alberta:

- Key Market Drivers: Alberta’s push to diversify beyond oil and gas, coupled with supportive solar rebates and a deregulated electricity market, fuels rapid solar expansion.

- Job Landscape: Commercial-scale projects are on the rise, creating openings for installers with large-project experience.

- British Columbia (BC):

- Key Market Drivers: Environmental awareness ranks high, and many homes—especially on Vancouver Island and in the Lower Mainland—embrace solar for both ethical and economic reasons.

- Challenges: Coastal weather can affect solar yields, but robust net metering policies and municipal incentives help offset concerns.

- Quebec:

- Key Market Drivers: Though hydro dominates this province’s renewable mix, solar is increasingly featured in new construction projects.

- Job Landscape: Bilingual installers with a knack for navigating unique municipal permitting processes have an edge.

- Prairie Provinces (Saskatchewan, Manitoba):

- Key Market Drivers: High insolation levels and growing interest in decentralized power solutions.

- Rural Opportunities: Farm-based solar, cooperative ventures, and local mini-grids create demand for adaptable installation teams.

- Atlantic Canada (Nova Scotia, New Brunswick, Newfoundland & Labrador, Prince Edward Island):

- Key Market Drivers: Smaller markets but progressive policies, including net metering and community solar programs.

- Job Landscape: Projects tend to be modest in scope, yet collectively they stimulate a consistent hiring trend.

5.2 Table: Installer Demand, Salary Ranges, and Market Outlook by Province

Below is a simplified illustration showing relative demand, approximate salary ranges for entry- to mid-level installers, and an overview of the market outlook. Note these figures are approximate and can vary based on certifications, employer size, and project complexity.

| Province | Relative Demand (Low/Med/High) | Salary Range (CAD/year) | Market Outlook (2025–2030) |

| Ontario | High | 40k–60k | Steady growth; ongoing residential adoption |

| Alberta | High | 45k–65k | Rapid expansion; incentives fueling projects |

| British Columbia | Med-High | 40k–60k | Strong urban interest; stable rural demand |

| Quebec | Med | 40k–55k | Growing slowly; overshadowed by hydro |

| Saskatchewan | Med | 45k–60k | Notable solar potential; rising project count |

| Manitoba | Med | 45k–60k | Evolving energy policy; moderate expansion |

| Atlantic Provinces | Low-Med | 38k–55k | Incremental gains; smaller-scale deployments |

Key Insights from the Table

- High-Demand Regions: Ontario and Alberta consistently register top-tier demand.

- Competitive Wages: Solar panel installer salaries often hover in the same range as other skilled trades, though specialized certifications can bump up pay.

- Long-Term Prospects: Over the next five to ten years, every province is expected to expand its solar footprint—though at different rates.

- Q: Do I need a specific license to install solar panels in Canada?

A: It often depends on the province. Generally, installers must be certified electricians or work under a licensed professional. Certain locations also require specialized endorsements linked to renewable energy systems. Always check local regulations and building codes to ensure compliance. - Q: Is previous construction experience necessary to become a solar installer?

A: While not strictly mandatory, a background in construction trades or electrical work can significantly reduce the learning curve. Many installation companies prefer candidates who’ve worked on rooftops or carried out electrical tasks. - Q: How does seasonality affect job availability?

A: In many Canadian regions, solar installations peak during warmer months, which means heavier workloads in spring and summer. However, utility-scale projects might continue year-round, ensuring more consistent employment.

6. Challenges in Hiring Solar Panel Installers

Picking up from our earlier discussion, we explore the obstacles businesses face when trying to secure and retain qualified solar panel installers. While Canada’s solar market is booming, the supply of skilled professionals sometimes struggles to keep up with the expanding demand.

6.1 Talent Shortages and Training Gaps

- Rapid Industry Growth: As solar projects proliferate, training programs have not always expanded at the same rate, resulting in labor shortages.

- Geographical Disparities: Rural or remote regions face even bigger hiring hurdles because prospective employees often gravitate toward major urban hubs.

- Limited Vocational Pathways: Although more colleges and trade schools are introducing solar-related curricula, widespread specialized training is still in development.

Key Takeaway:

A shortage of certified solar installers can lead to project delays, heightened salary competition, and potential bottlenecks in large-scale developments. Addressing these training and education gaps is crucial for sustaining long-term growth.

6.2 Seasonal Project Cycles and Workforce Planning

Because much of Canada experiences harsh winters, solar installations often peak during milder seasons:

- Spring and Summer Demand: Companies must ramp up hiring during these peak months when installations accelerate.

- Off-Season Retention: During colder seasons, businesses have to strike a balance between retaining employees and managing overhead costs.

Potential Solutions:

- Flexible Workforce Models: Employ seasonal labor or contract workers who return each year.

- Year-Round Training Programs: During downtime, companies can invest in advanced training, ensuring that installers stay up to date on industry best practices and emerging technologies.

6.3 Regulatory Hurdles and Licensing

Canadian provinces often have varying regulations, permitting requirements, and electrical codes:

- Complex Approval Processes: Delays in municipal or provincial approvals can extend project timelines.

- Licensing Requirements: Installers may need specific provincial electrician certifications or renewable energy endorsements.

- Inconsistent Codes: Building codes differ from one jurisdiction to another, forcing installers to adapt their methods for each site.

Key Takeaway:

A thorough understanding of local regulations saves time and money. Staffing agencies and contractors who maintain a pool of professionals familiar with multiple provincial codes gain a competitive edge.

7. Opportunities and Strategies for Staffing

Despite obstacles, the Canadian solar industry presents fertile ground for companies and recruiters willing to adopt proactive and innovative approaches.

7.1 Partnering with Trade Schools and Apprenticeships

- Direct Talent Pipeline: Working directly with trade schools or technical institutes can fill entry-level roles quickly.

- Work-Study Programs: Joint initiatives with educational institutions provide students hands-on experience while helping companies scout new talent.

- Mentorship and Apprenticeships: Offering structured apprenticeship programs establishes loyalty and ensures that new hires receive appropriate guidance and skill development.

7.2 Leveraging Technology for Recruitment and Training

- Online Job Platforms: Specialized sites that focus on renewable energy industries can help identify installers with relevant backgrounds and certifications.

- Virtual Classrooms: Webinars, e-learning courses, and virtual training modules foster continuous professional development.

- Remote Interviews and Assessments: Conducting initial interviews virtually widens the applicant pool, reaching talented candidates outside immediate geographic areas.

7.3 Offering Competitive Compensation and Growth Paths

- Compensation Benchmarks: Regularly review average salary ranges in your region (see the table in Section 5.2) to ensure your pay scale remains competitive.

- Performance-Based Incentives: Bonuses for meeting installation targets or adhering to strict safety standards can motivate teams.

- Career Progression: Clear pathways to supervisory or managerial roles attract candidates who seek long-term stability.

8. Best Practices for Solar Companies and Contractors

Solar firms can optimize their workforce by implementing a few strategic measures that streamline operations and elevate employee satisfaction.

8.1 Efficient Onboarding and Team Integration

- Orientation Programs: Introduce new hires to company culture, policies, and project workflows.

- Buddy System: Pair less experienced installers with seasoned team members, accelerating the learning curve.

- Safety Drills: Integrate safety training sessions right from the start to underscore the importance of protective measures.

8.2 Upskilling and Continuous Learning Programs

- Modular Training: Offer short, focused courses on emerging technologies—like battery storage or advanced inverter systems—so employees can expand their technical repertoire.

- Cross-Training: Encourage staff to learn multiple aspects of installations (electrical, mounting, wiring) for flexible team deployment.

- Certification Support: Reimburse fees for recognized credentials (e.g., NABCEP, CSA Group modules). This investment in professional development signals long-term commitment to the workforce.

8.3 Employee Retention Tactics

- Competitive Benefit Packages: Beyond salary, consider health insurance, paid leave, and retirement contributions.

- Work-Life Balance: Solar installations sometimes involve weekend or extended-hour projects. Rotating schedules help employees maintain a healthy personal life.

- Open Communication: Regular feedback and acknowledgment of achievements foster a positive team environment.

9. Future Outlook for Solar Installation in Canada

Looking ahead, the Canadian solar landscape appears ripe with opportunities. Legislative trends, technological advancements, and market forces will continue to shape how businesses recruit and how installers approach their craft.

9.1 Emerging Technologies and Their Impact on the Workforce

- High-Efficiency PV Cells: As panel efficiency climbs, installation workflows might shift, demanding up-to-date training on handling newer module designs.

- Energy Storage Innovations: Batteries are becoming more crucial, especially in regions with less reliable grid infrastructure. Installers with storage expertise will be in particularly high demand.

- Smart Grid and IoT: The integration of Internet of Things (IoT) and real-time monitoring tools requires workforce proficiency in electronics, data analytics, and IT systems.

9.2 Policy Trends and Long-Term Market Projections

- Stricter Emission Targets: Federal initiatives aiming at net-zero emissions by 2050 could intensify the focus on solar investments, further escalating installer demand.

- Green Stimulus Plans: Economic stimulus packages targeting renewables might allocate funds for solar workforce development, reinforcing skill-building programs.

- Community Solar Growth: Group-owned solar projects, particularly in rural or underserved communities, expand access and create continuous work opportunities across multiple provinces.

Key Takeaway:

Staying informed about upcoming policy changes ensures that companies, contractors, and installers can adapt promptly. A proactive approach to market trends—whether technological, legislative, or cultural—will position them to thrive in a dynamic environment.

FAQs

- Q: Are solar installers in Canada typically unionized?

A: It varies by region and employer. Some companies have union contracts that regulate wages and working conditions, especially for large commercial or utility-scale projects. Independent contractors may choose not to unionize, but union involvement can provide benefits such as collective bargaining power and standardized wages. - Q: What safety certifications are most relevant for Canadian solar installers?

A: At a minimum, installers often require Fall Protection and First Aid certifications. Many contractors also prefer candidates who have completed WHMIS (Workplace Hazardous Materials Information System) training, especially if they handle batteries or other specialized materials. - Q: Is bilingualism important for solar panel installers in Canada?

A: While not mandatory in most provinces, bilingualism (English and French) can be a significant advantage in Quebec and parts of Eastern Canada. It can also help installers communicate effectively with diverse clientele or access a broader range of job opportunities. - Q: How can companies better manage installation timelines in regions with cold or snowy winters?

A: Some firms pre-assemble certain components off-site and schedule on-site work during more favorable weather windows. Additionally, employing heated shelters or specialized winter gear can help maintain productivity and safety in subzero conditions. - Q: What role do solar financing options play in increasing installer demand?

A: Flexible financing arrangements like power purchase agreements (PPAs), leasing, or pay-as-you-go (PAYG) models lower the initial costs for consumers. As these models gain popularity, more homeowners and businesses opt for solar, leading to a surge in installations and the need for more skilled workers. - Q: Are there any government grants to help companies train new solar installers?

A: Training grants and employment subsidies vary by province. For instance, some provincial programs offer partial wage subsidies for registered apprentices, while federal initiatives may help offset the costs of specialized certifications. It’s advisable for companies to consult local employment centers or government websites to explore available options.

10. Conclusion

10.1 Key Takeaways on Solar Panel Installer Demand

Throughout this article, we’ve explored the multifaceted reasons behind Canada’s escalating demand for skilled solar panel installers. Strong government incentives, a growing consumer preference for renewable energy, and technological strides in photovoltaic equipment all converge to drive installation projects forward. Although the market faces hurdles—talent shortages, variable regional regulations, and seasonal work cycles—strategic investments in recruitment, training, and employee retention can mitigate these challenges.

10.2 Action Steps for Stakeholders

For solar panel companies and contractors:

- Collaborate with Trade Schools to build pipelines of qualified entry-level personnel.

- Diversify Hiring Strategies by advertising across specialized job boards and adopting virtual recruitment methods.

- Invest in Upskilling so experienced workers can handle advanced tech like energy storage and smart monitoring solutions.

- Stay Compliant with local licensing and safety standards to ensure smooth project rollouts.

For job seekers in the solar industry:

- Obtain Relevant Certifications (NABCEP, CSA) to enhance your resume and prove competence.

- Focus on Safety and Technical Skills—these remain foundational.

- Stay Flexible and consider relocating to high-demand regions like Ontario or Alberta for expanded opportunities.

If you’re looking to strengthen your solar panel installation team or explore the latest opportunities in the Canadian solar market, RSS Staffing Agency can help you find the right fit. Contact us today to discuss tailored workforce solutions that ensure your projects stay on track and on budget.

By combining smart hiring practices, comprehensive training initiatives, and a keen awareness of evolving market trends, solar companies and contractors in Canada can rise to meet the booming demand for qualified installers. Embracing this potential sets the stage not only for commercial success but also for a cleaner, more sustainable energy future across the nation.